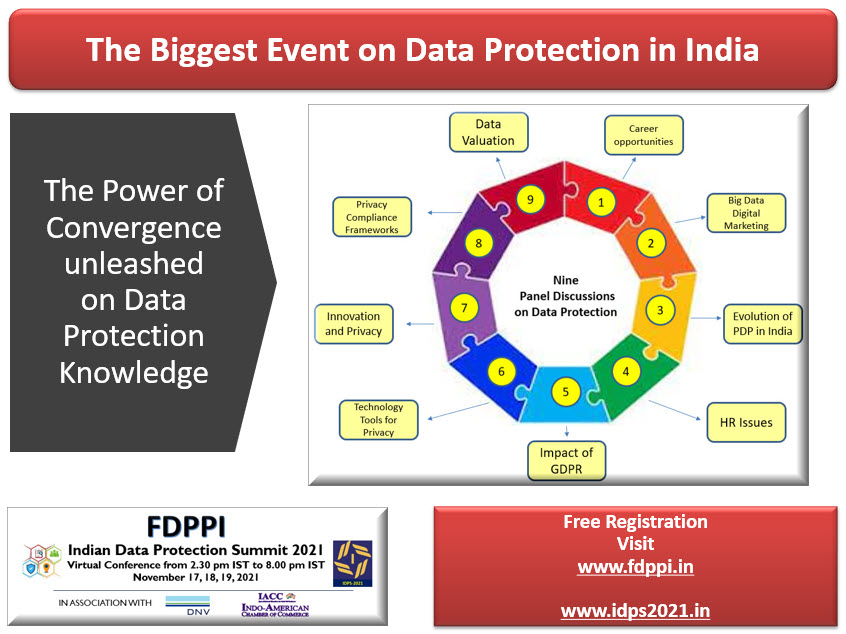

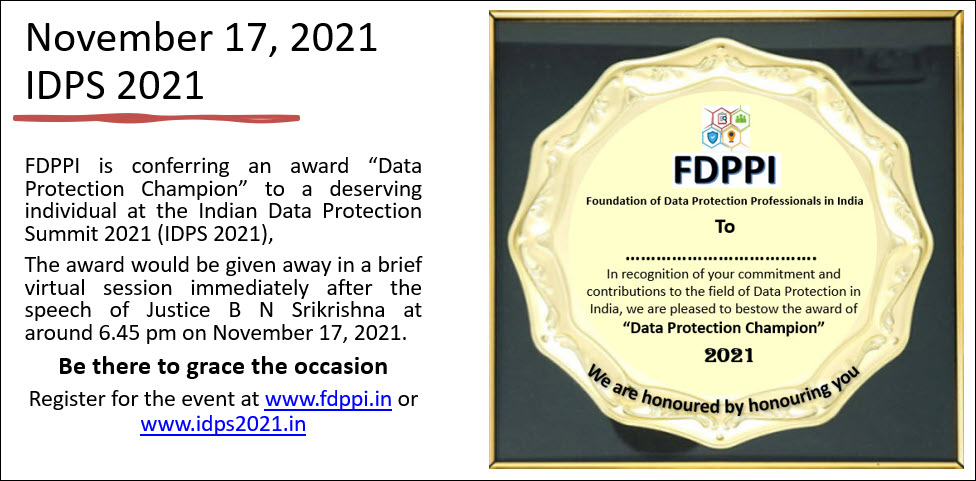

Biggest Event on Data Protection in India to open on November 17th

PDPB 2019 in its past life…

As we are discussing PDPB 2019 as the Data Protection legislation of India today, it becomes necessary that we remember that this is the new incarnation of an earlier Bill called “Personal Data Protection Bill 2006” which was introduced in the Indian Paliament along with the ITA 2000 amendment bill of 2006 which became the ITA amendment act 2008 and got passed in December 2008. The PDPB 2006 however lapsed and was forgotten

But for those of us interested in studying the legislative history of Indian legislation on Data Protection, it is important to recognize the PDPB 2006 as the past Janma of PDPB 2019.

A complete discussion of this Bill was held by Naavi under the aegis of Digital Society of India way bac on 17th October 2008 as part of the Digital Society Day celebrations. It was hosted by KLE Law College and supported by KILPAR. Some of the photographs of the event are interesting.

Mr Suresh Kumar, the then Law Minister of Karnataka inaugurated a seminar on Privacy on October 17, 2008 at KLE Law College, Bangalore, seen here with Naavi

Mr Suresh Kumar, the then Law Minister of Karnataka inaugurated a seminar on Privacy on October 17, 2008 at KLE Law College, Bangalore, seen here with Naavi

Complete details of the event are available available here .

A Copy of the Personal Data Protection Bill 2006 presented in the Parliament at that time is available here and is worth looking into when analyzing the legislative history of PDPB 2019.

When the Indian Data Protection Summit 2021 (IDPS 2021) discusses the Past, Present and Future of Privacy Law in India, it is necessary to remember this 2006 version of the Bill which faded into oblivion.

Naavi

FDPPI Launches Indian National Privacy Awareness Movement

Naavi, the Chairman of FDPPI had earlier undertaken “Karnataka Cyber Law Awareness Movement” in 2005 during which long certification courses were conducted across Karnataka in Bangalore, Mysore, Hubli and Mangalore under the umbrella of Cyber Law College.

Cyber Law College is a division of Ujvala Consultants Pvt Ltd which is a supporting partner of FDPPI.

In a new comprehensive outreach program, Naavi is now scheduling an “Indian National Privacy Awareness Movement” (INPAM) starting from the Vijayadashami day on 15th October 2021.

The INPAM would be a free program aimed at ordinary citizens and students to make them aware of the concept of “Privacy”, “Data Protection” and the “PDPB 2019”.

The program would be conducted on the Mobile App- FDPPI available here:

https://play.google.com/store/apps/details?id=co.edvin.titge (For Android)

https://apps.apple.com/in/app/myinstitute/id1472483563 (For ioS)

Please download the App and await further instructions on the batches.

The program would initially be launched in English and Kannada and later different batches would be introduced in different languages.

Naavi

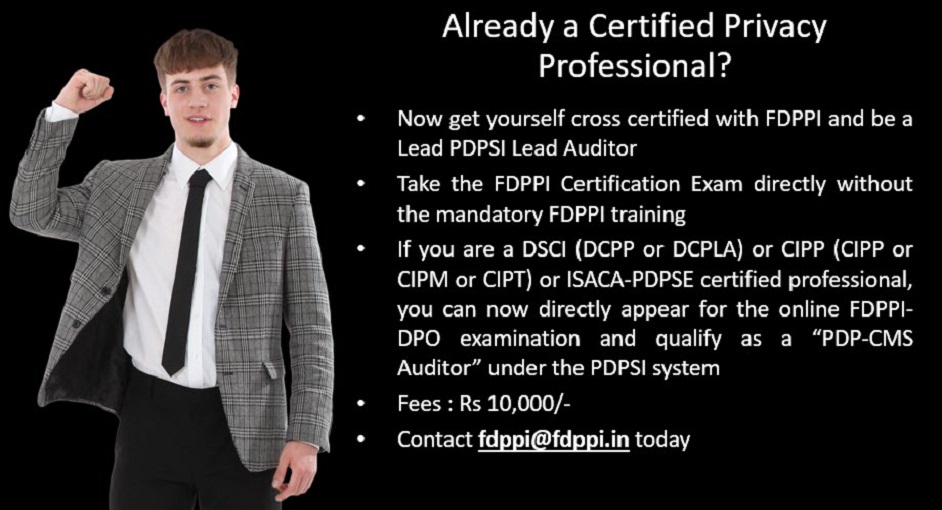

If you are already a Certified Privacy Professional…this PDPSI webinar will make you even more valuable

This is a special offer to professionals who already have one of the Privacy Certifications from DSCI or IAPP or ISACA.

Please contact FDPPI by e-mail with a copy of the certificate. On receipt of the confirmation, payment can be made.

Naavi

(To Register for the course go to the Registration page here: )

Be an FDPPI-DNV Certified Personal Data Protection Compliance Auditor

(PS: Registration for the October program is now closed. New program will commence in November 2021 after the IDPS 2021 (Indian Data Protection Summit 2021)

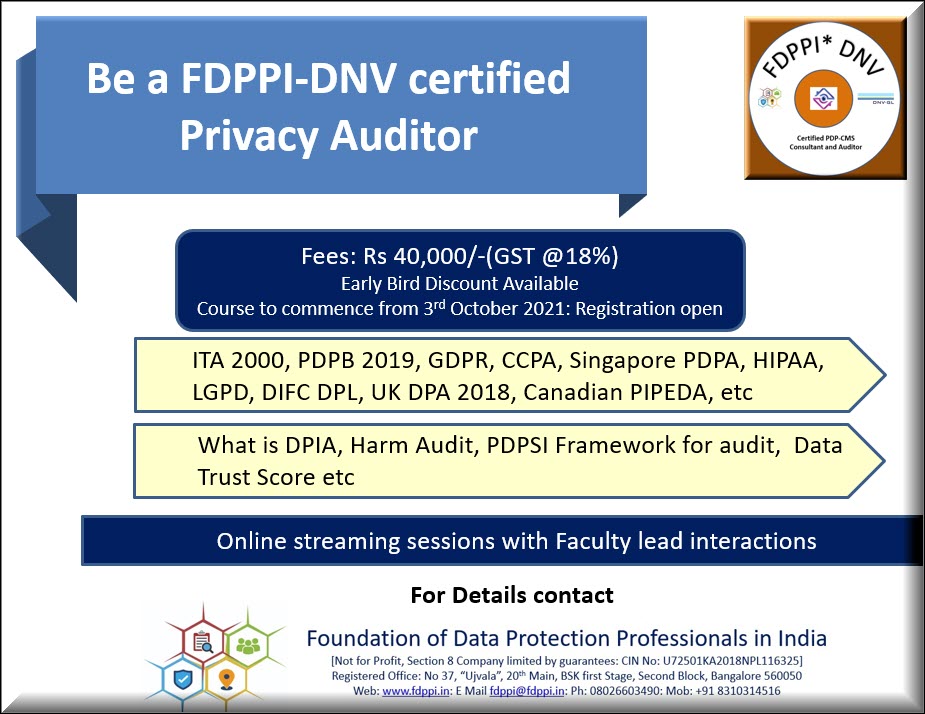

FDPPI has been conducting certification program for Data Protection Professionals preparing them to take up the responsibility as Data Protection Officers in organizations or as consultants and Auditors who can assist and certify organizations to be compliant with Data Protection regulations.

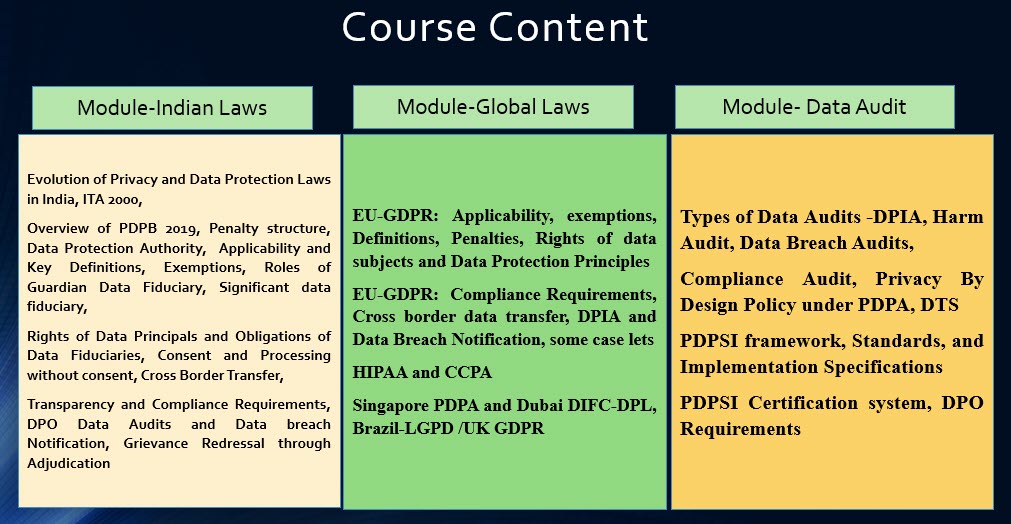

In a three module program, FDPPI imparts knowledge of Indian Data Protection Laws, Global Data Protection Laws and the Data Audit skills, through an online training program.

The Program would be conducted as a three week program. Each week the material for the week in written form and on the form of streaming videos approximately of 12 hours would be provided for the participants to study. Each Sunday, a faculty interaction would be conducted online at 11..00 am and clarifications if any would be provided.

After completion of the three interactive sessions by 24th October, examination would be held on 30th and 31st October. There will be three online examinations for 90 minutes each first and second examinations on Module I and II would be held on Saturday the 30th at 10.00 am and 3.00 pm. Module III examination would be held on 31st at 10.00 am.

The fee for the course would be Rs 40,000/- plus GST at 18% (Total 47,200) and payable in advance before September 30, 2021. The application form and the link for payment is available at the end of this page.

Early bird discount of Rs 3000/- would be available upto 18th September 2021. Fees upto September 18th 2021 would therefore be Rs 37000/- plus GST @18% (Total Rs 43660/-)

All participants of the webinar on PDPSI to be held on September 19, 2021 would be provided a discount of Rs 2000/-, till October 2nd 2021.

For further clarifications, kindly contact Naavi over e-mail.

Persons interested in enrolling for the program may kindly complete the form below and make the necessary payment.

The fee includes complimentary membership of FDPPI. The default membership would be the basic membership.

A Feedback from a participant of the previous program:

What was unique about this training and certification was the depth of coverage. With Naavi Sir being an expert in ITA 2000/08, he was able to bring in the required relevance and he was able to quote on specific cases and how ITA 2000/08 by itself includes data privacy requirements. His references to the HC judgements on matters of Personal Data Protection emphasized the importance. The content and teaching were well rounded and inclusive of surrounding aspects that perhaps one cannot expect in more mundane training programmes. The content presented by Ramesh Sir was very very elaborate on GDPR and all encompassing …. the discussions and points made by Naavi Sir while clarifying our doubts were themselves like a separate training session with valuable insights conveyed which he had gathered over the years …. overall it was a very enriching imparting of knowledge…. K.N.NarasingaRao, (Consultant, ICT at IIMB Bengaluru)

Application for Enrollment for Certification Program

P.S: Training is offered by Cyber Law College (Ujvala Consultants Pvt Ltd) as Training Partner

For more details, contact FDPPI over email. over fdppi@ fdppi.in

Press Release-PDPSI webinar

5th September 2021

PRESS RELEASE

FDPPI Proposes a New Data Privacy Compliance Framework

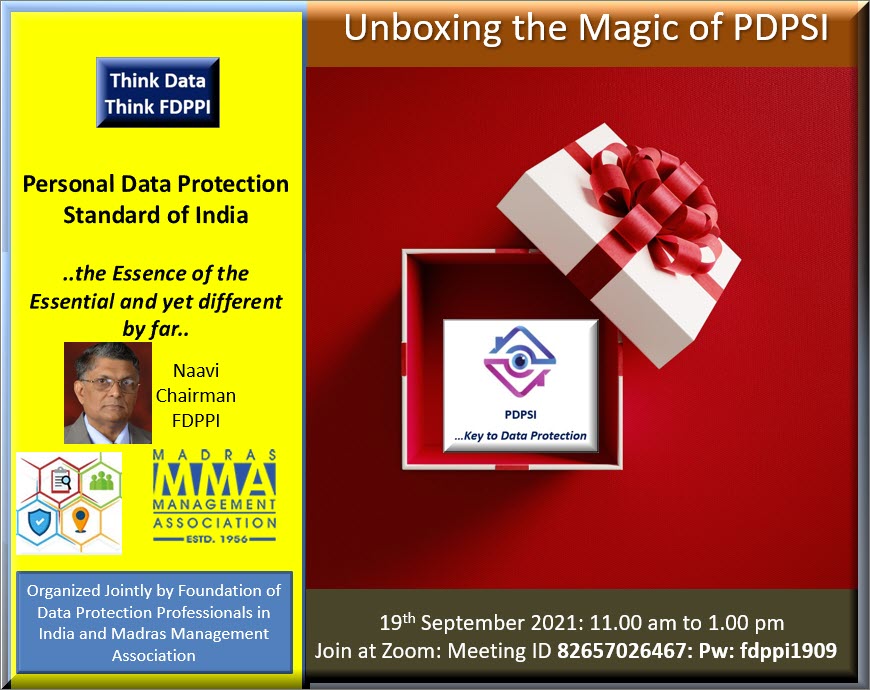

Foundation of Data Protection Professionals in India (FDPPI) is organizing a free webinar on 19th September 2021, to build awareness on a unique Data Protection Compliance framework that can help the data processing industry in India to meet the Data Privacy obligations under the current Data Protection regulations applicable to Indian establishments.

The framework called “Personal Data Protection Standard of India” (PDPSI) is a unified framework that can assist a company to be compliant with the data protection requirements under Information Technology Act 2000, the proposed Personal Data Protection Bill 2019 (PDPB 2019) as well as GDPR and other international data protection regulations that may be applicable to Indian establishments.

PDPSI is a revolutionary concept “Made in India for the World” and incorporates several innovative futuristic ideas such as computation of “Data Trust Score” (DTS) and incorporating Data Valuation System in corporate Governance.

FDPPI has already developed a team of trained Auditors and Consultants and also created a group of Certification bodies which can undertake Consultancy and Audit based on the PDPSI framework and certify them for the Management.

When the PDPB 2019 is passed, the Government of India will set up a Data Protection Authority which will introduce codes of practice for industries to follow. PDPSI is an advance proactive initiative from the industry professionals to develop a system of compliance in tune with the global standards and flexible enough to meet the emerging requirements of PDPB 2019 when passed.

The webinar will be conducted by Naavi, the veteran Data Protection and Governance consultant, founder of www.naavi.org and Founder Chairman of FDPPI . During the webinar, Naavi will introduce the Standard and its implementation specifications with comparison of similar frameworks available from other agencies.

The webinar is sponsored by FDPPI for the benefit of Data Protection professionals in India to spread awareness of this framework. Registration would be free. The webinar would be conducted on September 19, 2021 (Sunday) from 11.00 am to 1.00 pm. Entry by registration at www.fdppi.in or through e-mail fdppi@fdppi.in

Sd

Chairman

FDPPI

Unboxing the Magic of PDPSI

PDPSI or Personal Data Protection Act of India is a compliance framework that is unique. It has been developed by professionals with years of experience in the field of Privacy and Data Protection, as a unified framework for meeting the compliance of multiple data protection laws.

Unlike some of the other frameworks for PIMS (Personal Information Management System) or or DPMS (Data Privacy Management System), PDPSI is a compliance framework for “Personal Data Protection Compliance Management System” (PDP-CMS).

Again unlike the PIMS or DPMS systems which are an extension of other ISMS systems, PDPSI is a standalone system that has a focus on the compliance requirement to a target jurisdiction.

Unlike other PIMS or DPMS systems, PDPSI framework for PDP-CMS extends to calculation of the Data Trust Score (DTS) which is a Trust Seal indicating the level of compliance maturity of an organization.

Naavi, Chairman of FDPPI which is developing a system of Accredited PDP-CMS auditors, Certification Bodies and a system of Certification, will be explaining the salient features of PDPSI and why it is a comprehensive and forward looking compliance model appropriate for Data Controllers and Data Fiduciaries.

The two hour session on 19th September 2021 will be conducted as an Online webinar at 11.00 am and is offered free on registration.

We are happy to have Madras Management Association is partnering in this awareness building initiative.

Those interested in registration may complete the following form or send an e-mail to FDPPI.

16th KSHAN National Appelllate Moot Court Competition

The GH Raisoni Law College is organizing its 16th KSHAN Moot Court which will be held on the 4th and 5th of September, 2021 on a virtual platform.

As a part of the FDPPI’s activities under the P& Y Program to involve the youth of the country into the activities of FDPPI, FDPPI is collaborating with the GH Raisoni Law College, Nagpur in the conduct of the above Moot Court Competition. This is the 16th National Appellate Moot Court Competition -2021 is being organized by students of G.H. Raisoni Law College, Nagpur and G.H. Raisoni University’s School of Law. All India Reporter (AIR), and FDPPI- are collaborating in the conduct of this program.

Dr Mahendra Limaye, one of our esteemed members has been the brain behind the P& Y Program and the organization of this event.

As a part of the collaboration, FDPPI would be extending valuable educational opportunities to the Winners and the First and Second Runner’s up as rewards.

We look forward to involvement in more of such programs in association with law colleges.

About KSHAN

KSHAN is a National Level, inter-college moot court competition organized by the student bodies of the Law Schools under the Raisoni Group of Institutions. They conduct a nationally known Trial and Appellate Moot Court on Criminal Law. This year’s edition of KSHAN is the only Appellate Moot Court that has a special focus on Criminal Writ Petition and Data Privacy.

About AIR

AIR (All India Reporter) is a publication house known for its presence in all three media information transmission forms: Print, CD-ROM and Web base. It has a journal that reports on all benchmark judgements given by various courts around India. It was established in 1914 and has its head office in Nagpur.

The problem statement of the competition is available here.

FDPPI has announced the following rewards.

1. Winner: Free Certification Course-Admission, Video lessons and Examination for Module I and Module G and Basic Membership of FDPPI : Valued at Rs 25,000/-

2. First Runner up: Free Certification Course-Admission, Video lessons and Examination for Module I and Basic Membership of FDPPI: Valued at Rs 14,000

3.Second Runner up: Free Certification Course-Admission, Video lessons and Examination for Module I: Valued at Rs 10,000/-